The decision to handle tax preparation in-house or outsource it is a critical one for accounting, CPA, and EA firms. With the increasing complexity of tax regulations and the demands of peak tax season, making the right choice can directly impact your firm’s efficiency, client satisfaction, and profitability.

This guide walks you through a step-by-step approach to evaluate your firm’s needs, weigh your options, and arrive at a practical decision that aligns with your goals.

Step 1: Evaluate Your Current Tax Preparation Workflow

The first step is to understand how your current tax preparation process operates.

Ask yourself these questions

- Is your team struggling with deadlines during busy seasons?

- Are you relying on outdated technology that slows down efficiency?

- Do you have enough skilled staff to handle your current and future client base?

Example: If you’ve noticed frequent overtime during tax season or delays in delivering returns to clients, it’s a sign your current workflow might not be sustainable.

Checklist

- Is your team overworked during peak times?

- Are you experiencing delays in meeting client deadlines?

- Are your tax prep tools and software up to date?

- Are errors or compliance issues frequently flagged?

Step 2: Understand Your Clients’ Needs

Your clients’ needs play a significant role in determining whether in-house or outsourced tax preparation is the right choice.

Analyze Client Complexity

- Do you handle a high volume of simple returns that require speed over complexity?

- Are your clients’ returns complex, requiring in-depth knowledge of multi-state taxes, international tax laws, or specialized industries?

Client Expectations

- Are clients demanding quicker turnaround times or more personalized service?

Example: A boutique CPA firm that caters to high-net-worth individuals with unique tax situations might lean towards in-house prep for critical client-facing tasks but outsource basic data processing to save time.

Checklist

- Are most of your clients’ returns simple or highly complex?

- Are there seasonal spikes in your client workload?

- Do your clients require rapid turnarounds or specialized expertise?

Step 3: Test Outsourcing on a Small Scale

Outsourcing Tax Preparation doesn’t have to be an all-or-nothing decision. Start small by outsourcing a portion of your tax preparation work to see how it fits with your firm’s operations.

How to Begin

- Select a trusted outsourcing provider.

- Assign them basic returns or high-volume tasks (e.g., individual tax filings).

- Monitor the quality of work, turnaround times, and communication processes.

Evaluate Results

- Compare the costs, accuracy, and efficiency of outsourcing against your in-house processes.

- Gather feedback from your team on whether outsourcing reduced their workload.

Example: A mid-sized CPA firm outsourced 20% of its workload during tax season and, reported faster client delivery times and reduced staff burnout without compromising on quality.

Checklist

- Did the outsourcing partner deliver work on time?

- Was the quality and accuracy of the work satisfactory?

- Were costs within your budget?

- Did outsourcing free up your team for higher-value tasks?

Step 4: Consider a Hybrid Model

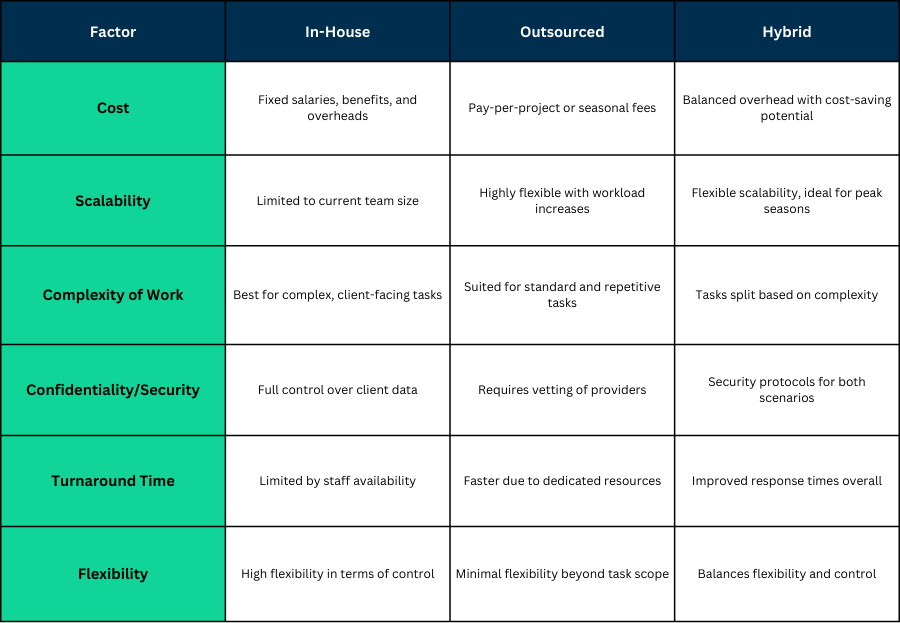

A hybrid approach combines the best of both worlds

- Keep critical tasks like high-value or complex returns in-house to ensure direct control.

- Outsource routine, repetitive, or seasonal work to an external provider to reduce workload during peak times.

Benefits of a Hybrid Model

- Improved scalability during busy seasons.

- Balanced control over sensitive or complex returns.

- Cost savings by outsourcing low-skill, high-volume tasks.

Example: A small firm with a handful of experienced CPAs retained control over business tax filings while outsourcing straightforward individual tax returns during tax season. This approach saved time and allowed them to focus on advisory services.

Checklist

- Have you identified which tasks are critical to keep in-house?

- Have you set clear processes for outsourced work?

- Is the hybrid model helping you optimize costs and efficiency?

Step 5: Use a Practical Decision-Making Template

Step 6: Ensure Data Security and Compliance

When outsourcing, safeguarding client data is crucial. Before finalizing an outsourcing partner.

- Confirm they use encrypted data transfer methods.

- Review their compliance with IRS and state-level regulations.

- Check for a proven track record in handling sensitive financial data.

Example: A firm that outsourced tax preparation to a provider with advanced cybersecurity protocols reduced their data security concerns while improving efficiency.

Conclusion

Choosing between in-house and outsourced tax preparation isn’t just about cost—it’s about aligning the decision with your firm’s goals, client expectations, and operational needs. By evaluating your workflow, understanding your clients, testing outsourcing on a small scale, and considering a hybrid model, you can make an informed decision that sets your firm up for long-term success.

Ready to explore outsourcing options for tax preparation? Contact us today to learn how our expert services can help your firm scale efficiently, reduce overhead costs, and improve client satisfaction.

Let’s find the best solution for your firm’s needs!